.

.

Electronic payments, which allow for the exchange of funds through paperless methods, are safer, easier and more reliable than paper checks.

Direct deposit is the electronic transfer of a payment from a company or organization into an individual's checking or savings account. When you get your federal benefit payment electronically, the U.S. Department of the Treasury sends an electronic message to your bank or credit union or Direct Express® Debit Mastercard® card account crediting your account with the exact amount of your benefit payment. The difference is, your check isn't printed or mailed. The federal government and most businesses use direct deposit to transfer millions of dollars every day. Your money is safe with direct deposit. To learn more about direct deposit, you can talk to your local bank or credit union. With direct deposit, your money goes straight into your account at the same time each month, giving you more control over your money. It eliminates the risk of stolen checks and forged signatures and helps protect you from identity theft. Direct deposit also provides immediate access to your money from virtually anywhere.

The U.S. Department of the Treasury has no plans to interrupt the payment of federal benefits. Check payments will continue as normal, however, people who have not converted their paper check to electronic payment are out of compliance with the law as of March 1, 2013. The U.S. Department of the Treasury will continue to contact check recipients who are not in compliance with the law and may send beneficiaries a Direct Express® Debit Mastercard®.

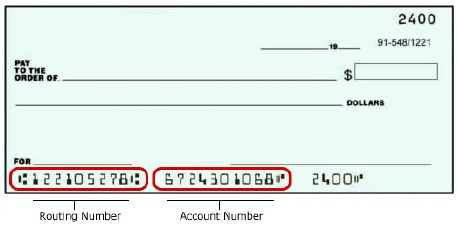

Your bank routing number can be obtained by using one of the options below:

- Locate the first set digits at the bottom of your personal check (image above). This should be a nine-digit number. (Do not use a deposit slip if the nine-digit routing number begins with a "5" as this will not be valid for direct deposit)

- Contact your financial institution for this information.

Your bank account number can be obtained by using one of the options below:

- Locate the second set of digits at the bottom on your personal check (image above).

- Contact your financial institution for this information.

For additional assistance, contact the U.S. Treasury Electronic Payment Solution Center at 1-877-874-6347.

You can contact the U.S. Electronic Payment Solution Center (EPSC) by calling 1-877-874-6347 or by mailing correspondence to:

Go Direct Processing Center

U.S. Department of the Treasury

PO Box 650527

Dallas, TX 75265-0527

Paying agency contact information can be found here.

If you are already receiving your federal benefit payment by direct deposit, and would like to have your payments sent to a new or different account, contact the federal agency that pays your benefits. A list of the paying agencies contact information can be found here.

If you want to change from the Direct Express® card or any other card type to a bank or credit union, contact your paying agency directly. A list of the paying agencies contact information can be found here.

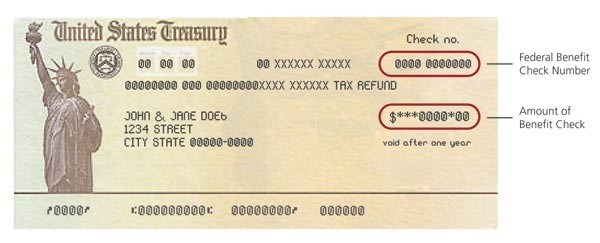

If you are unable to obtain your benefit check number, you can use your claim number.

If you are unable to locate either the benefit check number or claim number, contact the U.S. Treasury Electronic Payment Solution Center at 1-877-874-6347.

To obtain the benefit check number, you will have to wait until you have received a payment by check. If you have already received a check, the number is located in the top right-hand corner of your federal check. The benefit check number is 12-digits in length and appears as a four-digit number, a space, and an eight-digit number.

A claim number can be found on any correspondence from the federal paying agency or on a Medicare Identification card. For Supplemental Security Income (SSI) payments, the claim number is the benefit recipient’s social security number.

The check or claim number you provided was not recognized by the GoDirect® online enrollment system. Verify if the number you have entered matches the check or claim number listed on official correspondence. If you are unable to locate your claim or benefit check number, or if you continue to receive this error after you have verified your information, contact the U.S. Treasury Electronic Payment Solution Center at 1-877-874-6347.

To learn more about the Direct Express® card, visit www.usdirectexpress.com or contact Direct Express® Customer Service directly 24 hours/7 days a week at 1-888-741-1115.

The GoDirect.gov site only accepts direct deposit enrollments. To convert your federal benefit check to electronic payment using a Direct Express® card, contact the U.S. Treasury Electronic Payment Solution Center at 1-877-874-6347.

To sign up for direct deposit or a Direct Express® card, choose one of the options listed below. To enroll, you must receive at least one paper check by mail. You may enroll in direct deposit or an electronic payment by contacting your paying agency before your first check is issued. Note: We do not accept faxes or third-party forms.

- Enroll online (direct deposit only): www.godirect.gov.

- Call the U.S. Treasury Electronic Payment Solution Center at 1-877-874-6347.

- Mail a FS 1200 Enrollment form to the U.S. Treasury Electronic Payment Solution Center address below. If you do not have a form, you can download it here.

Go Direct Processing Center

U.S. Department of the Treasury

P.O Box 650527

Dallas, TX 75265-0527

You will need to have at least one federal benefit check and the following information readily available:

- Social Security Number

- Information from your most recent benefit check or claim number

- Date of birth (for Direct Express®)

- Financial Institution’s routing number (for direct deposit to a financial institution)

- Account number and account type (checking or savings) (for direct deposit to a financial institution)

Direct deposit normally takes 1 to 2 pay cycles to process. Until then, benefit checks will continue to be sent by mail. You may receive one to two more paper checks before the direct deposit begins.

The process to convert your payment to direct deposit can take 4-6 weeks, or one to two payment cycles.

The U.S. Treasury Electronic Payment Solution Center can only enroll Social Security (SSA), Supplemental Security Income (SSI), Railroad Retirement (RRB), Civil Service (Office of Personnel Management (OPM)), and most Veterans Affairs (VA) payments (in the benefit recipients’ name only). For other payment types, contact your paying agency to enroll. A list of the paying agencies contact information can be found here.

For more information or assistance, contact the U.S. Treasury Electronic Payment Solution Center at 1-877-874-6347.

Yes, enrollments can be accepted by mail. For more information, click here.

Yes. Benefit recipients or representative payees can still comply with the law and convert to an electronic payment option and sign up for direct deposit or the Direct Express® card by contacting the U.S. Treasury Electronic Payment Solution Center at 1-877-874-6347.

The U.S. Department of the Treasury recommends the Direct Express® card, a prepaid debit card payment option for federal benefit recipients who don't have a bank or credit union account. Additional information about the Direct Express® card is available at www.USDirectExpress.com.

When you sign up to receive your Social Security (SSA), Supplemental Security Income (SSI), Railroad Retirement (RRB), Civil Service (Office of Personnel Management (OPM)), or Veterans Affairs (VA) payments via the Direct Express® card, your money will be automatically deposited to your card account on your payment date each month.

Direct deposit can take 1 to 2 payment cycles to take effect. You may receive one or more paper checks before the direct deposit takes effect. Do not discard your benefit check. Cash your check as you normally would after you enroll.

While your direct deposit request is being processed, you will continue to receive your monthly payment by mail on your scheduled payment date. Direct deposit can take 1 to 2 payment cycles to take effect. You may receive one or more paper checks before the direct deposit takes effect. Do not discard your benefit check. Cash your check as you normally would after you enroll.

If you continue to receive your federal benefit payment by check after two pay cycles, contact the U.S. Treasury Electronic Payment Solution center at (877) 874-6347 for assistance.

The GoDirect® online enrollment system converts paper federal benefit checks to electronic payment. The GoDirect® online enrollment system does not determine your entitlement for payment or issuance of your federal benefit payment. For information regarding your federal payment, contact your federal paying agency. A list of paying agencies and their contact information can be found here.

The GoDirect® online enrollment system uses an automatic address listing which does not accept modifications. If you are experiencing issues, contact the U.S. Treasury Electronic Payment Solution Center at 1-877-874-6347.

If you received a duplicate error message, our records indicate there is an enrollment in progress that cannot be modified or cancelled online. To continue with a new enrollment, contact the U.S. Treasury Electronic Payment Solution Center at 1-877-874-6347.

Your email address is only used once to send a confirmation of the enrollment. To confirm the status of your enrollment, contact the U.S. Treasury Electronic Payment Solution Center at 1-877-874-6347.

The GoDirect® online enrollment system will not update an existing mailing address. Federal paying agencies maintain and update payment records. To avoid any delays in receiving your payment, notify your paying agency immediately with any changes or updates.

A list of paying agencies and their contact information can be found here.

Use the troubleshooting tips below to identify potential errors on the enrollment form:

- Do not use punctuation marks when entering the enrollment. The GoDirect® online enrollment system cannot accept punctuation marks.

- Enter your information exactly as it appears on your most recent federal benefit check:

- 12-digit benefit check number as it appears on the upper right hand side without any dashes or spaces

- Full representative payee name as it appears on the check, including middle name or middle initial, if applicable

- Full benefit recipient name as it appears on the check, including middle name or middle initial, if applicable

- The amount entered must match the check exactly. Requesting the amount of the federal benefit check is used for verification purposes only and will not be used again.

- All address lines (city, state, and zip code must be entered exactly as they appear on the face of the federal benefit check, even if the information is incorrect)

- The social security number should be entered without dashes.

If there is an error on your enrollment, you will need to re-enter your social security number for security reasons.

If you are still experiencing issues, contact the U.S. Treasury Electronic Payment Solution Center at 1-877-874-6347.

If you provided an email address when completing your direct deposit request through the GoDirect® online system, you will receive a confirmation email.

If you did not provide an email address during the online enrollment process, you may confirm your direct deposit request by contacting the U.S. Treasury Electronic Payment Solution Center at 1-877-874-6347.

Benefit recipients residing outside of the United States are excluded from the Treasury Mandate (31 CFR PART 208) and are not required to convert their federal benefit payments to direct deposit.

To use the GoDirect® online enrollment system for direct deposit, you must have a United States (U.S.) bank account or have an account that is a U.S. bank account within an overseas bank. If you reside outside of the U.S. in a country that offers international direct deposit, you may be able to enroll by mail. For more information regarding international direct deposit, contact your paying agency.

Contact your paying agency, the nearest U.S. consulate, or the nearest U.S. Embassy for assistance. Visit http://www.socialsecurity.gov/foreign/foreign.htm to view a list of U.S. Embassy addresses.

A final rule was published in December 2010 to gradually phase out paper checks for federal benefit payments. As of March 1, 2013, federal regulation (31 CFR PART 208) requires that all federal benefit recipients receive their federal benefit payments through an electronic payment option. This includes the following benefit payments:

- Social Security

- Supplemental Security Income

- Veterans Affairs

- Railroad Retirement Board

- Office of Personnel Management

- Department of Labor (Black Lung)

If you are not receiving your payment electronically, you are out of compliance with the law and must convert to receive payments through direct deposit to your bank or credit union account or a Direct Express® Debit Mastercard®. If you are receiving a payment on behalf of someone else (Representative Payee), refer to Does this rule apply to representative payees or to people who live in nursing homes? (See below question 3)

The U.S. Department of the Treasury will continue to contact you regarding non-compliance. You will continue receiving your benefit payments.

Yes. Federal regulation (31 CFR PART 208) requires that all federal benefit recipients receive their federal benefit payments through an electronic payment option. In rare circumstances a waiver, or exception, will be granted allowing benefit recipients to continue to receive paper checks. If you believe you are eligible for a waiver, contact the U.S. Treasury Electronic Payment Solution Center - Waiver Line at 1-855-290-1545.

If you care for someone who gets federal benefit payments by paper check or if you receive a check on behalf of someone else, the U.S. Department of the Treasury requires that these payments be converted to an electronic payment.

Representative payees can sign up for direct deposit or the Direct Express® Debit Mastercard® by calling the U.S. Treasury Electronic Payment Solution Center at 1-877-874-6347.

Representative payees should also note the following:

- A representative payee for a person over the age of 90 must convert the paper check payment to an electronic payment option. The rule exception granted for those over the age of 90 does not apply to people with a representative payee.

- Nursing homes and assisted living facilities that serve as the representative payee for residents also must switch check payments to electronic payments. Find additional information on the Nursing Facilities page.

For more information about representative payee responsibilities, consult the appropriate federal benefit agency.

The U.S. Department of the Treasury will grant exceptions to the rule only in rare circumstances. To request a waiver application, contact the U.S. Treasury Electronic Payment Solution Center – Waiver Line at 1-855-290-1545.

To qualify for a waiver, at least one of the following three criteria must be met:

- The check recipient is an individual to whom electronic payments would impose a hardship due to a mental impairment.

- The check recipient lives in a remote geographic location lacking the infrastructure to support electronic financial transactions.

- The check recipient is age 90 or above.

If you do not meet the criteria above, you are required to convert your federal benefit check to electronic payment. For more information or to request a waiver, call the U.S. Treasury Electronic Payment Solution Center – Waiver Line at 1-855-290-1545. You may also print and fill out a waiver form and return it to the address on the form.